When shipping goods to China, customs clearance in China is necessarily on the agenda – a topic which often brings up questions. As specialist for cargo traffic on trade lane China, supporting shippers and consignees on this topic is part of our daily business. This article provides insights into procedures for clearing customs for import goods to China.

A question we regularly encounter is which checks import goods to China have to undergo to be customs cleared. There is no one general answer to this, because the Chinese customs system is indeed complex. The actual check- and clearing processes depend on the nature of goods, the type of shipment and the customs procedure chosen, that is goods imported e.g.

Despite the diversity of the system, there are some points which might be interesting for shippers to know. Here is an overview.

Clearing customs in China involves two official authorities – one of them is what is often called 'the Chinese customs'.

Important for shippers to know:

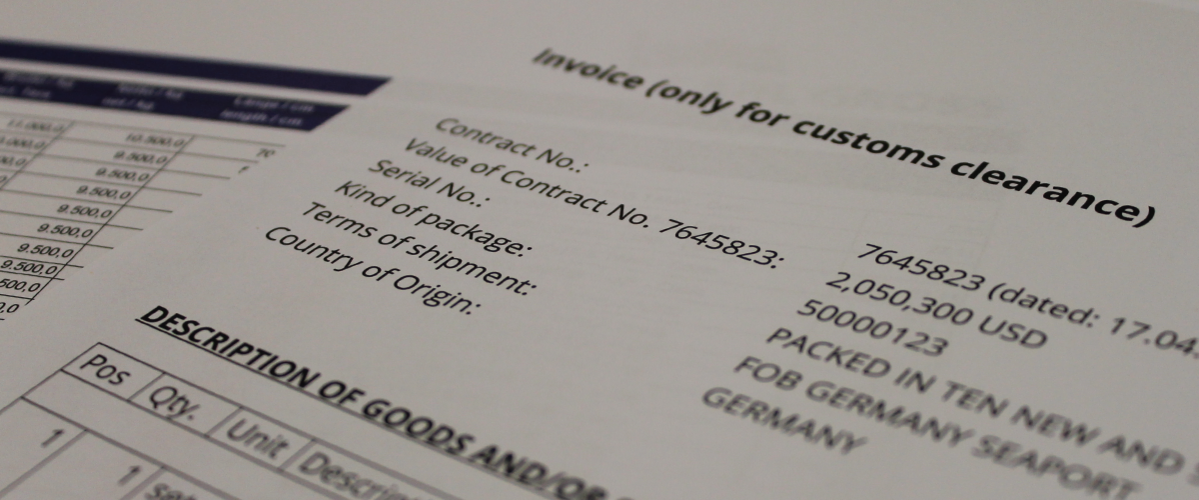

For checking the customs tariff, the commercial invoice and the packing list are reviewed for completeness and coherence. The commercial invoice needs to state the HS Code (Harmonized System), the monetary value and a detailed description for each article of the shipment.

For the packing list, make sure to list the net and the gross weight as well as the type of packaging of each article. Both documents need to be made out in English language at least – better in Chinese. As the data in both documents needs to be coherent, we recommend also having a very close eye on uniform spelling in both documents.

Next to the above mentioned documents, the Chinese customs also needs a corresponding export declaration and the shipping documents (bill of lading or air waybill respectively).

These papers are the basis upon which the Chinese customs decide if the goods have to undergo further examinations or if they can determine the customs tariff, applicable on basis of their document review.

Specific commodities require a certificate.

Are the goods appropriate for use in China – the CIQ check

The CIQ – Chinese Inspection and Quarantine – is a second authority involved in the import clearance process. The CIQ examines if the goods to be imported are appropriate for the use in the People’s Republic of China. They are concerned e.g. with products which require a CCC-Certificate (China Compulsory System) to be eligible for import. This applies to machines, for example, for which CIQ requires proof that their electricity system complies with the Chinese one and that they meet local security standards and regulations. But it is not only electrical products which need special certification. Another common example is fire extinguishers which are included in or integrated to machinery or other equipment.

Important for shippers to know:

If any part of a shipment requires special certification for import to China it should be evaluated before you are even planning to send the goods and the corresponding measures should be taken to prevent additional costs during the import process or even to face the rejection of importing them by Chinese authorities.

If both authorities give the go-ahead, goods may be picked up and transported to their final destination.